Borrowing Money for Your Business

What do you mean by Borrowing Money for Your Business?

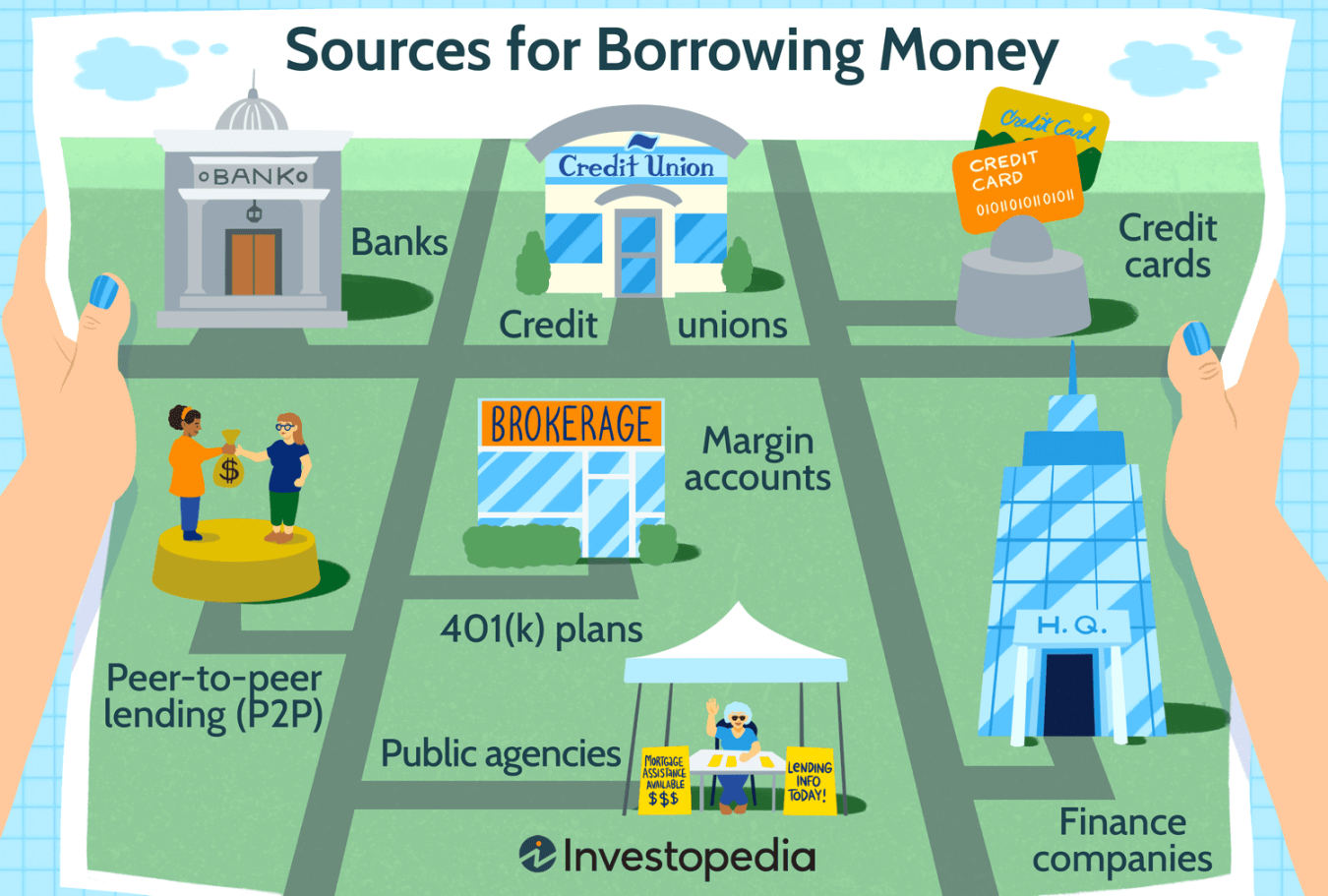

When you start a business or need to grow an existing one, you may find that you need to access additional funds. One way to do this is by borrowing money. This means taking out a loan from a bank, financial institution, or other lender, with the agreement that you will pay back the amount borrowed plus interest over a set period of time.

How can you Borrow Money for Your Business?

There are several ways to borrow money for your business. You can apply for a traditional business loan from a bank or credit union, where you’ll need to provide a detailed business plan, financial statements, and other documentation. Another option is to seek funding from online lenders, which may have less stringent requirements but higher interest rates. You could also consider borrowing from friends or family, using a business credit card, or taking out a line of credit.

What is known about Borrowing Money for Your Business?

Borrowing money for your business can be a risky but necessary step in growing your company. It’s important to carefully consider your options and choose the financing option that best suits your needs and financial situation. You should also be aware of the terms of the loan, including the interest rate, repayment schedule, and any fees or penalties for late payments.

Solution for Borrowing Money for Your Business

If you’re considering borrowing money for your business, it’s essential to do your research and compare different lenders and loan options. Make sure you understand the terms of the loan and how it will impact your cash flow and profitability. Create a solid business plan that outlines how you will use the funds and how you plan to repay the loan. Seek advice from financial advisors or mentors to help you make the best decision for your business.

Information about Borrowing Money for Your Business

When borrowing money for your business, it’s important to consider the amount you need, the purpose of the loan, and how you will repay it. You should also be aware of your credit score and financial history, as these factors will impact your ability to qualify for a loan and the interest rate you’ll be offered. Be prepared to provide detailed financial information and documentation to lenders to support your loan application.

Conclusion

Borrowing money for your business can be a strategic way to fuel growth and expansion, but it’s essential to approach it with caution and careful planning. By understanding your options, researching lenders, and creating a solid repayment plan, you can make borrowing money a successful and sustainable strategy for achieving your business goals.

FAQs

1. How much money can I borrow for my business?

The amount you can borrow for your business will depend on various factors, such as your credit score, financial history, and the purpose of the loan.

2. What are the risks of borrowing money for my business?

The risks of borrowing money for your business include taking on debt that you may struggle to repay, paying high interest rates, and potentially damaging your credit score if you default on the loan.

3. How long does it take to get approved for a business loan?

The approval process for a business loan can vary depending on the lender and the amount of documentation required. It can take anywhere from a few days to several weeks to get approved.

4. Can I use a personal loan for my business?

While it’s possible to use a personal loan for your business, it’s generally not recommended. Personal loans typically have higher interest rates and may not offer the same benefits as a business loan.

5. What should I do if I’m struggling to repay a business loan?

If you’re having difficulty repaying a business loan, it’s essential to communicate with your lender and discuss alternative repayment options. You may be able to negotiate a new payment plan or seek financial assistance to help you meet your obligations.