Exploring the Benefits of Shopify Merchant Cash Advance

What do you mean by Shopify Merchant Cash Advance?

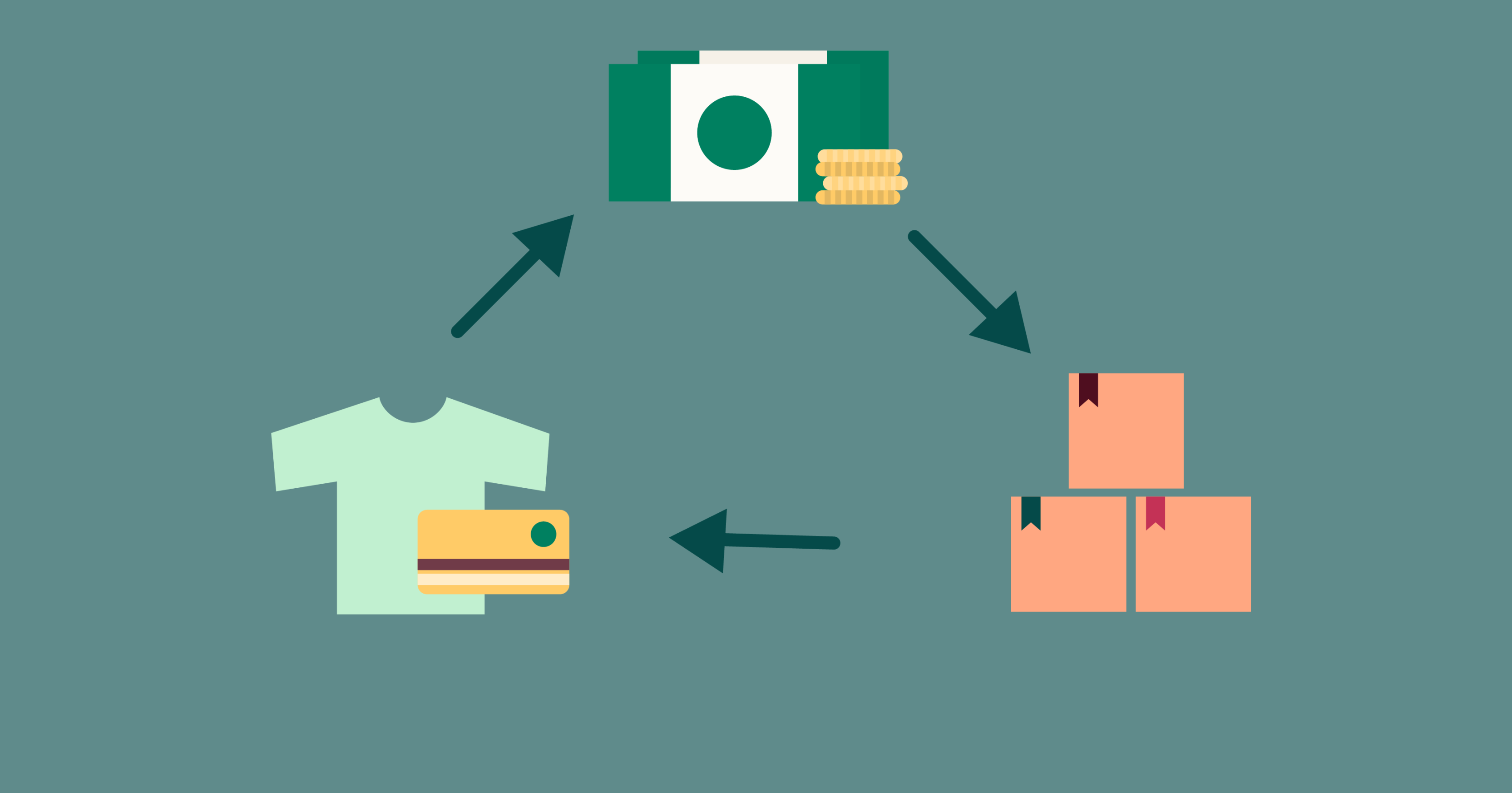

Shopify Merchant Cash Advance is a type of funding that is specifically designed for businesses that use the Shopify platform. This funding option allows Shopify merchants to receive a lump sum of money in exchange for a percentage of their daily credit card sales. The advance is repaid through a percentage of the daily sales volume, making it a convenient and flexible financing option for Shopify businesses.

How does Shopify Merchant Cash Advance work?

When a Shopify merchant applies for a cash advance, the funding provider will review the business’s sales history, credit card processing volume, and other relevant financial information to determine the amount of funding they are eligible for. Once approved, the merchant will receive the funds in their account within a few days. The repayment terms are typically based on a percentage of the merchant’s daily credit card sales, making it a seamless and transparent process.

What is known about Shopify Merchant Cash Advance?

Shopify Merchant Cash Advance is known for its quick approval process, flexible repayment terms, and convenience for Shopify businesses. Unlike traditional loans, cash advances do not require collateral or a high credit score, making them accessible to a wide range of businesses. Additionally, the repayment structure ensures that merchants can manage their cash flow effectively without the stress of fixed monthly payments.

Solution for Shopify Merchants

For Shopify merchants who need quick access to capital to support their business growth, Shopify Merchant Cash Advance can be a viable solution. Whether they need funds to purchase inventory, expand their marketing efforts, or cover unexpected expenses, a cash advance provides the flexibility and speed required to keep their business running smoothly.

Information about Shopify Merchant Cash Advance

Shopify Merchant Cash Advance is a financing option that is tailored to the needs of Shopify businesses. With a simple application process, fast approval, and flexible repayment terms, it is a convenient way for merchants to access the funds they need without the hassle of traditional loans. By leveraging their daily credit card sales, Shopify merchants can receive the capital they need to grow and thrive in today’s competitive market.

Conclusion

In conclusion, Shopify Merchant Cash Advance is a valuable financing option for Shopify merchants who need quick access to capital. With its convenience, flexibility, and transparent repayment structure, it provides a seamless solution for businesses looking to grow and succeed. By exploring the benefits of a cash advance, Shopify merchants can take their business to the next level and achieve their goals.

FAQs

1. How long does it take to get approved for a Shopify Merchant Cash Advance?

Typically, the approval process for a Shopify Merchant Cash Advance can take a few days, depending on the funding provider’s review of the merchant’s financial information.

2. Are there any restrictions on how I can use the funds from a Shopify Merchant Cash Advance?

Once approved, Shopify merchants can use the funds from a cash advance for any business-related expenses, such as purchasing inventory, marketing, or covering operational costs.

3. Can Shopify Merchant Cash Advance affect my credit score?

Since a cash advance is based on the merchant’s credit card sales, it does not impact their credit score like traditional loans. However, timely repayment is essential to maintain a positive financial standing.

4. Is collateral required for a Shopify Merchant Cash Advance?

No, collateral is not required for a cash advance, making it a low-risk financing option for Shopify merchants who may not have valuable assets to pledge.

5. How can I apply for a Shopify Merchant Cash Advance?

Shopify merchants can apply for a cash advance through a reputable funding provider that specializes in offering financing options for businesses using the Shopify platform. The application process is typically straightforward and can be completed online.