Borrow Money for Small Business

What do you mean by borrowing money for a small business?

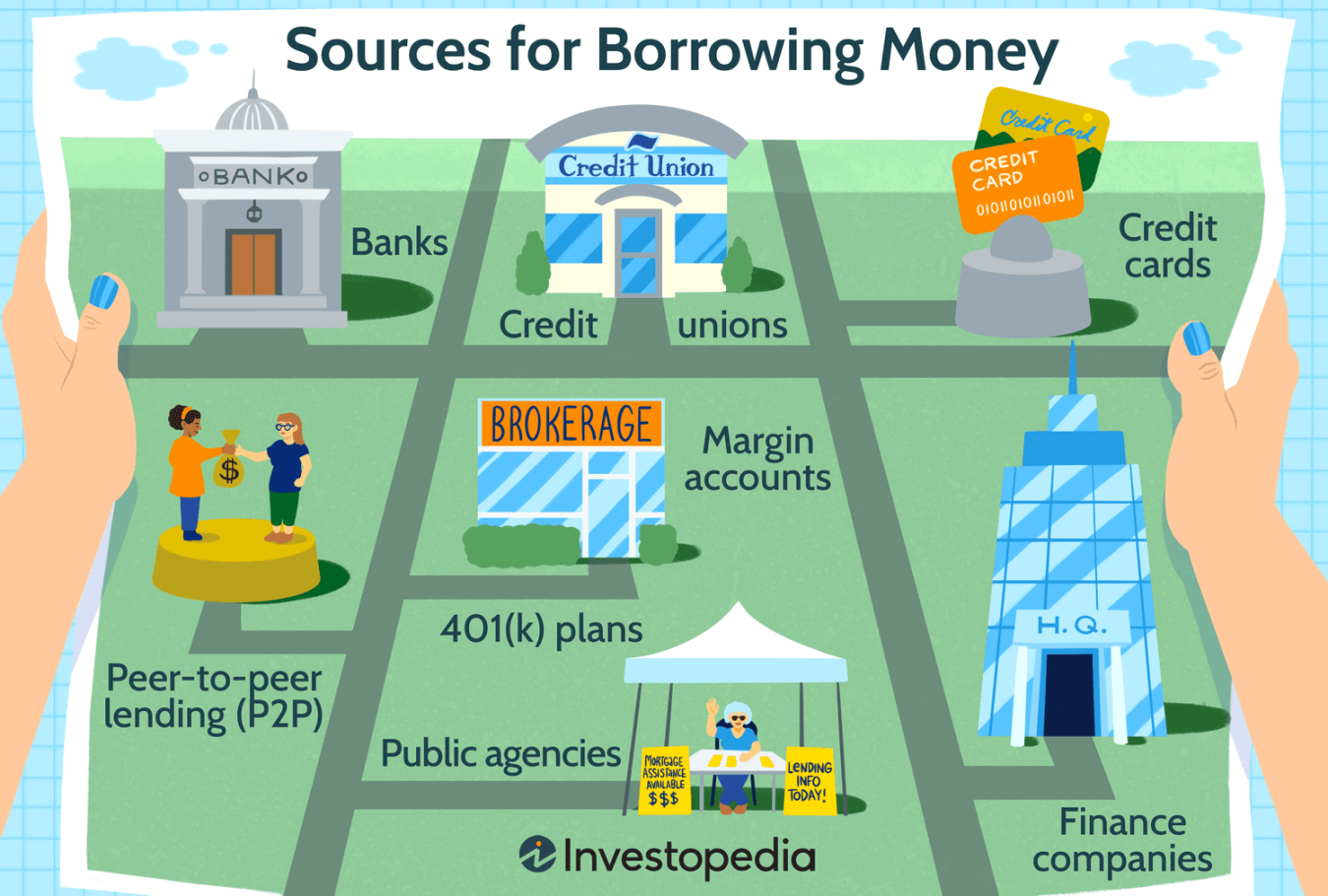

When you start a small business, you may need additional capital to fund your operations, purchase inventory, hire employees, or expand your business. Borrowing money for a small business means taking out a loan or line of credit to finance these needs. This can be done from a bank, credit union, online lender, or other financial institution.

How can you borrow money for a small business?

To borrow money for a small business, you will need to first determine how much money you need and what type of loan or credit line best suits your needs. You can then research different lenders, compare interest rates and terms, and apply for a loan. Lenders will evaluate your creditworthiness, business plan, and financial statements to determine if you qualify for a loan.

What is known about borrowing money for a small business?

Borrowing money for a small business can be a crucial step in growing your business or overcoming financial challenges. It can help you take advantage of new opportunities, increase your cash flow, and improve your business’s overall financial health. However, it is important to carefully consider the terms of the loan, your ability to repay it, and the potential risks involved in borrowing money.

Solution for borrowing money for a small business

One solution for borrowing money for a small business is to create a detailed business plan that outlines your goals, financial projections, and how you plan to use the borrowed funds. This can help you demonstrate to lenders that you are a viable and responsible borrower. Additionally, you can consider alternative funding options such as crowdfunding, grants, or angel investors.

Information about borrowing money for a small business

When borrowing money for a small business, it is important to understand the different types of loans available, such as term loans, lines of credit, SBA loans, and equipment financing. You should also be aware of the interest rates, fees, repayment terms, and collateral requirements associated with each type of loan. It is recommended to work with a financial advisor or accountant to help you navigate the borrowing process.

Conclusion

In conclusion, borrowing money for a small business can be a strategic way to finance your business’s growth and success. By carefully researching your options, understanding the terms of the loan, and creating a solid business plan, you can increase your chances of securing the funding you need. Remember to borrow responsibly and prioritize repaying your loans to maintain good financial health for your small business.

FAQs about borrowing money for a small business

1. Can I borrow money for a small business with bad credit?

Yes, you may still be able to borrow money for a small business with bad credit, but you may face higher interest rates and stricter terms.

2. How long does it take to get approved for a small business loan?

The approval process for a small business loan can vary depending on the lender, but it typically takes anywhere from a few days to a few weeks.

3. What are some alternative funding options for small businesses?

Some alternative funding options for small businesses include crowdfunding, grants, angel investors, and venture capital.

4. How much can I borrow for a small business loan?

The amount you can borrow for a small business loan depends on factors such as your business’s financial health, creditworthiness, and the type of loan you are applying for.

5. What should I consider before borrowing money for a small business?

Before borrowing money for a small business, consider factors such as your ability to repay the loan, the impact on your cash flow, and the potential risks involved in taking on debt.