Merchant Loans: A Comprehensive Guide

What do you mean by a merchant loan?

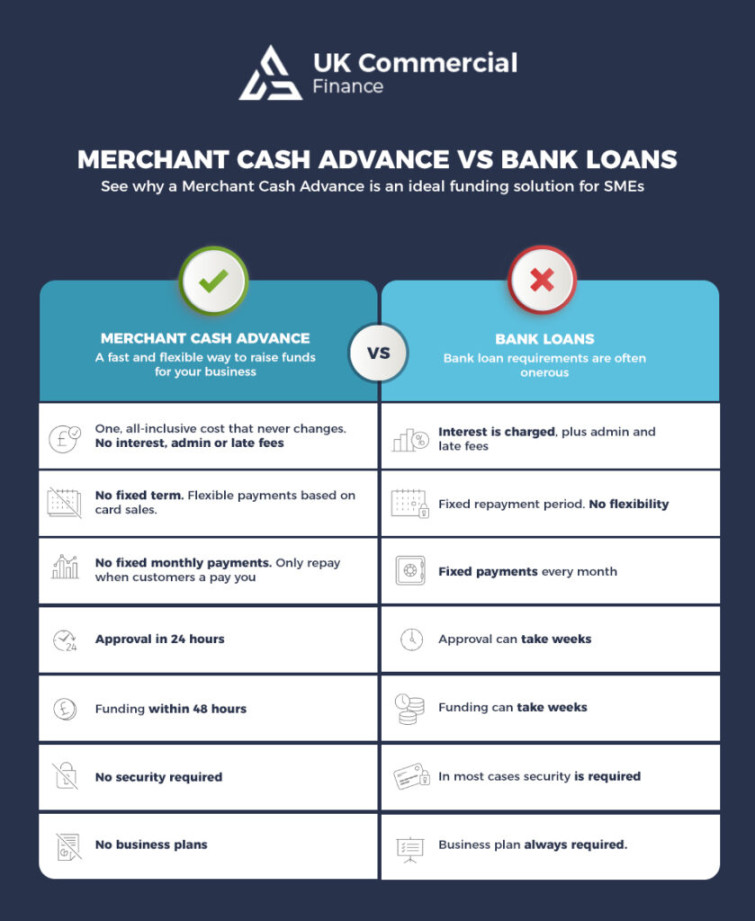

A merchant loan, also known as a merchant cash advance, is a type of business loan that is specifically designed for businesses that accept credit card payments. This type of financing provides quick access to capital for merchants who need funds to cover expenses or invest in growth opportunities.

How does a merchant loan work?

Merchant loans work by providing businesses with a lump sum of cash, which is then repaid through a percentage of their daily credit card sales. This repayment structure is known as a factor rate, which is a fixed fee based on the amount borrowed. The repayment process is seamless and convenient for merchants as it aligns with their cash flow.

What is known about merchant loans?

Merchant loans are known for their flexibility and convenience. Unlike traditional bank loans, merchant loans do not require extensive credit checks or collateral. This makes them an ideal financing option for small businesses or those with less-than-perfect credit scores. Additionally, the fast approval process and quick funding make merchant loans a popular choice for businesses in need of immediate capital.

What is the solution for businesses seeking a merchant loan?

For businesses seeking a merchant loan, the solution lies in finding a reputable lender that offers competitive terms and transparent pricing. It is essential to research different lenders, compare offers, and read reviews to ensure that you are partnering with a trustworthy financial institution. By choosing the right lender, businesses can access the funds they need to grow and thrive.

Information about merchant loans

Merchant loans are typically used for short-term financing needs, such as purchasing inventory, covering payroll, or investing in marketing campaigns. The loan amounts can vary depending on the business’s credit card sales volume, with some lenders offering funding of up to $500,000 or more. Repayment terms are flexible and can range from a few months to a year or more.

Conclusion

In conclusion, merchant loans are a valuable financing option for businesses that accept credit card payments. With their quick approval process, flexible repayment terms, and minimal requirements, merchant loans provide a convenient solution for businesses in need of immediate capital. By understanding how merchant loans work and researching different lenders, businesses can make informed decisions and access the funds they need to achieve their goals.

FAQs

1. Are merchant loans only available to businesses that accept credit card payments?

Yes, merchant loans are specifically designed for businesses that accept credit card payments as their primary form of revenue.

2. How quickly can I expect to receive funding with a merchant loan?

Most merchant loan providers offer quick approval and funding, with funds typically disbursed within a few days of application approval.

3. What are the eligibility requirements for a merchant loan?

Eligibility requirements for merchant loans may vary depending on the lender, but typically include a minimum monthly credit card sales volume and a certain length of time in business.

4. Can I use a merchant loan for any business expenses?

Yes, merchant loans can be used for a variety of business expenses, such as purchasing inventory, covering payroll, investing in marketing, or expanding operations.

5. How does the repayment process work with a merchant loan?

Merchant loans are repaid through a percentage of daily credit card sales, making the process seamless and convenient for businesses with fluctuating revenue streams.