Apply for Merchant Cash Advance

What do you mean by a merchant cash advance?

A merchant cash advance is a type of business financing that allows a company to receive a lump sum payment in exchange for a percentage of its daily credit card sales. This funding option is particularly popular among small businesses that may not qualify for traditional bank loans.

How can you apply for a merchant cash advance?

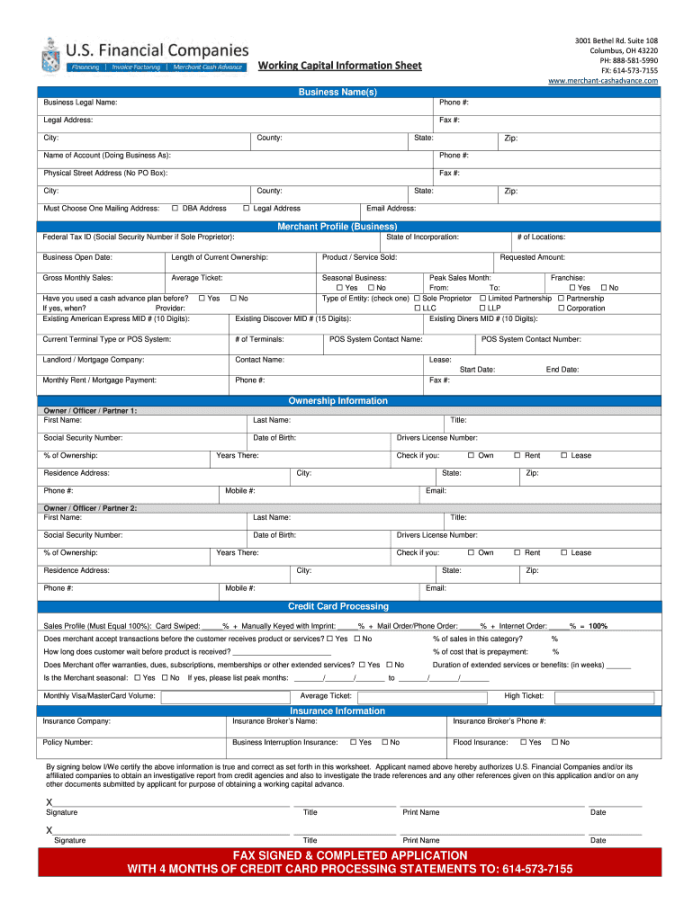

Applying for a merchant cash advance is a relatively simple process. Typically, all you need to do is fill out an online application form with basic information about your business, such as your monthly revenue, average credit card sales, and time in business. Once you submit the application, a funding provider will review your information and determine if you qualify for the advance.

What is known about merchant cash advances?

Merchant cash advances are known for their quick approval process and flexible repayment terms. Unlike traditional loans, merchant cash advances do not require collateral or a high credit score, making them accessible to a wide range of businesses. Additionally, the repayment structure is based on a percentage of your daily credit card sales, so payments adjust with your cash flow.

Solution for businesses in need of quick financing

For businesses in need of quick financing, a merchant cash advance can be a viable solution. Whether you need to cover unexpected expenses, purchase inventory, or expand your operations, a merchant cash advance provides the capital you need to keep your business running smoothly. With fast approval times and flexible repayment terms, it’s a convenient option for businesses with fluctuating cash flow.

Information to consider before applying for a merchant cash advance

Before applying for a merchant cash advance, it’s important to understand the terms and conditions of the agreement. Make sure you review the factor rate, which determines the total cost of the advance, as well as the repayment terms and any additional fees. It’s also advisable to compare offers from different funding providers to ensure you’re getting the best deal for your business.

FAQs about applying for a merchant cash advance

1. How long does it take to get approved for a merchant cash advance?

Approval times for merchant cash advances can vary depending on the funding provider, but most businesses receive a decision within 24-48 hours of submitting their application.

2. Can I qualify for a merchant cash advance with bad credit?

Yes, merchant cash advances are accessible to businesses with less-than-perfect credit. Funding providers typically look at your monthly revenue and credit card sales volume when determining approval.

3. What are the typical repayment terms for a merchant cash advance?

Repayment terms for merchant cash advances are based on a percentage of your daily credit card sales, so payments fluctuate with your revenue. This flexible structure is designed to accommodate businesses with seasonal or unpredictable cash flow.

4. Are there any restrictions on how I can use the funds from a merchant cash advance?

Unlike traditional bank loans, merchant cash advances do not come with restrictions on how you can use the funds. Whether you need to cover operating expenses, invest in new equipment, or launch a marketing campaign, the choice is yours.

5. What happens if I can’t make my daily payments on a merchant cash advance?

If you’re struggling to make your daily payments on a merchant cash advance, it’s important to communicate with your funding provider. They may be able to work out a modified repayment plan or provide additional support to help you get back on track.