Instant Merchant Cash Advance: Everything You Need to Know

What do you mean by Instant Merchant Cash Advance?

An Instant Merchant Cash Advance is a type of financial product that allows businesses to quickly access funds based on their future credit card sales. It provides a fast and easy way for merchants to obtain cash for their businesses without having to go through the lengthy process of applying for a traditional loan.

How does Instant Merchant Cash Advance work?

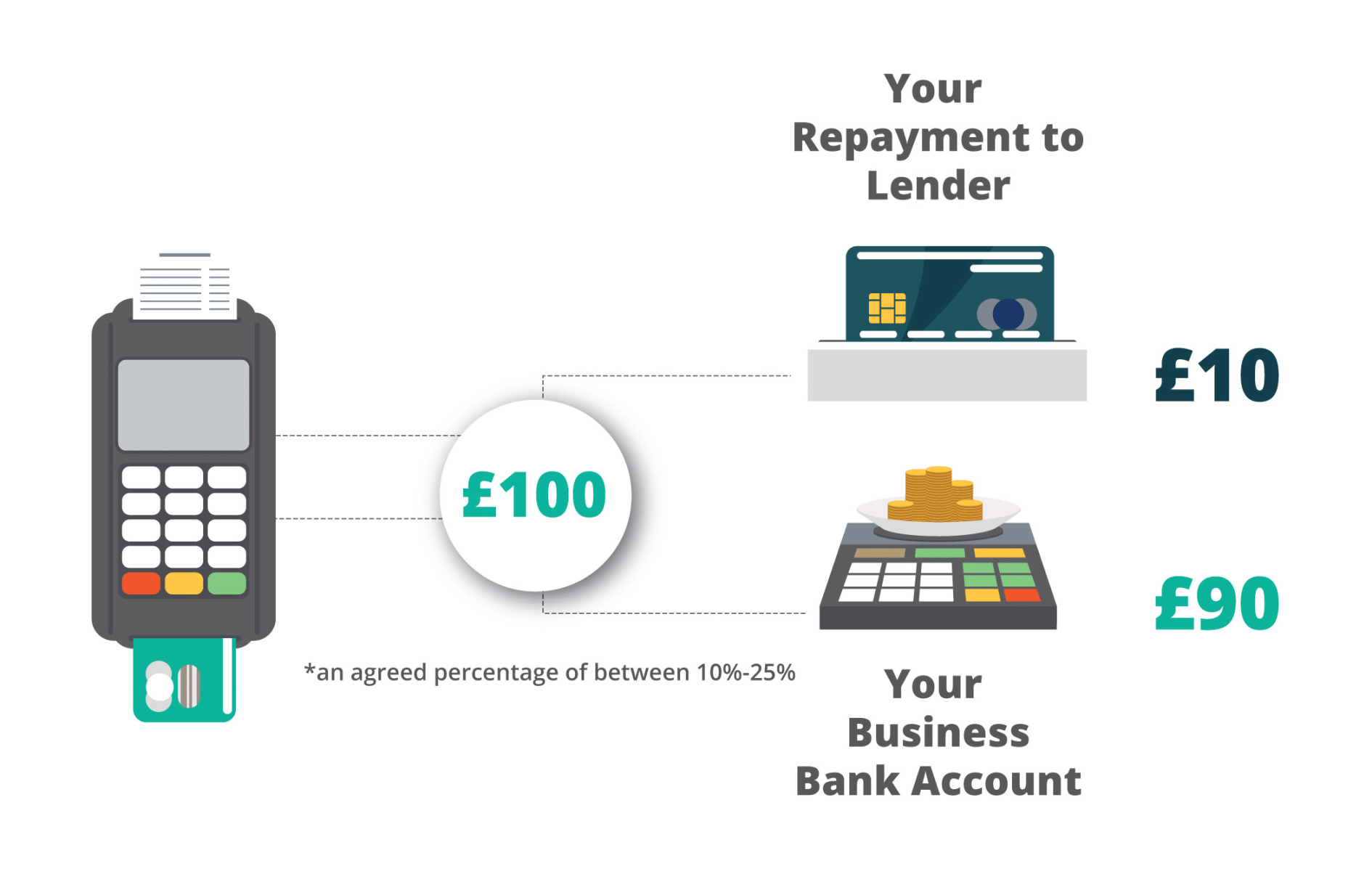

When a business applies for an Instant Merchant Cash Advance, the provider will review the business’s credit card sales history to determine the amount of cash that can be advanced. Once approved, the provider will give the business a lump sum of cash, which is then repaid through a percentage of the business’s daily credit card sales.

What is known about Instant Merchant Cash Advance?

Instant Merchant Cash Advance is known for its quick approval process and flexible repayment terms. It is a popular financing option for businesses that need cash quickly and cannot wait for a traditional loan approval process.

What is the solution Instant Merchant Cash Advance?

Instant Merchant Cash Advance can be a great solution for businesses that need quick access to cash for emergencies, expansion, or other financial needs. It provides a fast and easy way to access funds without the hassle of traditional loan applications.

Information about Instant Merchant Cash Advance

Instant Merchant Cash Advance is typically used by businesses that have a high volume of credit card sales. It is a convenient way to access cash without the need for collateral or a lengthy approval process. However, it is important to carefully review the terms and conditions of the advance to ensure that it is the right financing option for your business.

Conclusion

In conclusion, Instant Merchant Cash Advance can be a valuable financing option for businesses that need quick access to cash. It provides a fast and easy way to obtain funds based on future credit card sales, making it an attractive option for businesses with high credit card sales volume.

FAQs about Instant Merchant Cash Advance

1. How quickly can I receive funds with an Instant Merchant Cash Advance?

Typically, funds can be received within a few days of approval.

2. What are the repayment terms for an Instant Merchant Cash Advance?

Repayment is typically made through a percentage of daily credit card sales.

3. Is collateral required for an Instant Merchant Cash Advance?

No, collateral is not typically required for this type of financing.

4. Can businesses with low credit scores qualify for an Instant Merchant Cash Advance?

Yes, businesses with low credit scores may still qualify based on their credit card sales history.

5. Are there any fees associated with an Instant Merchant Cash Advance?

There may be fees associated with the advance, so it is important to review the terms and conditions carefully.

Thanks for every other informative website. Where else may just I get that type of information written in such a perfect approach? I have a venture that I’m simply now running on, and I’ve been at the glance out for such info.