Lending Money to a Company: How to Make Smart Investments

What do you mean by lending money to a company?

Lending money to a company involves providing financial assistance to a business in exchange for a promise of repayment with interest. This can be done through various methods such as loans, bonds, or other forms of financial instruments. Companies often seek funding from external sources to support their operations, expand their business, or invest in new projects. Lenders, on the other hand, stand to earn a return on their investment through interest payments or other financial incentives.

How does lending money to a company work?

When lending money to a company, investors typically conduct a thorough analysis of the business’s financial health, creditworthiness, and growth prospects. This may involve reviewing the company’s financial statements, assessing its market position, and evaluating its management team. Based on this information, investors can decide whether or not to provide funding to the company and under what terms. Once a lending agreement is in place, the company is responsible for repaying the loan amount plus interest according to the terms of the agreement.

What is known about lending money to a company?

Lending money to a company can be a lucrative investment opportunity for individuals and institutions looking to earn a return on their capital. By providing funding to businesses in need, investors can help support economic growth, job creation, and innovation. However, lending money to a company also carries risks, such as default risk, interest rate risk, and market risk. It is important for investors to carefully assess these risks and conduct thorough due diligence before making any investment decisions.

What are the solutions for lending money to a company?

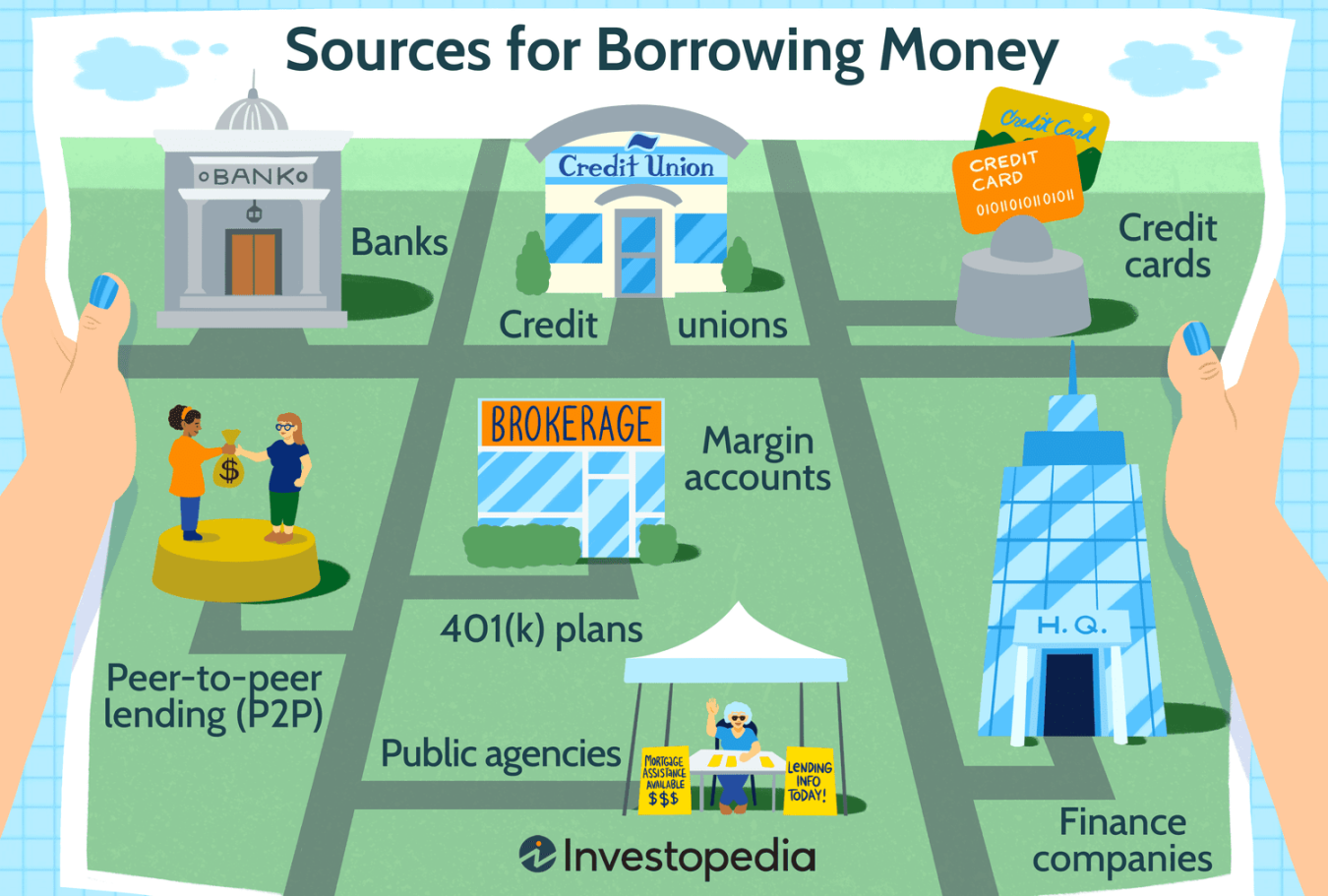

There are several ways to lend money to a company, depending on the investor’s preferences and risk tolerance. Some common methods include:

1. Direct Loans: Investors can provide funding directly to a company in the form of a loan with specified repayment terms and interest rates.

2. Bonds: Investors can purchase corporate bonds issued by companies seeking financing. Bonds typically pay a fixed interest rate and have a specified maturity date.

3. Peer-to-Peer Lending: Investors can participate in peer-to-peer lending platforms that connect borrowers with individual lenders for small business loans.

4. Crowdfunding: Investors can contribute funds to a company’s crowdfunding campaign in exchange for rewards or equity in the business.

Information on lending money to a company

Before lending money to a company, investors should consider the following factors:

1. Company’s Financial Health: Review the company’s financial statements, cash flow, and debt levels to assess its ability to repay the loan.

2. Industry Trends: Evaluate the company’s market position, competitive landscape, and growth prospects to understand its future potential.

3. Loan Terms: Negotiate the terms of the loan agreement, including interest rates, repayment schedule, and any collateral requirements.

4. Legal Considerations: Seek legal advice to ensure that the lending agreement complies with relevant laws and regulations.

Conclusion

Lending money to a company can be a rewarding investment opportunity for individuals and institutions looking to support businesses in need of funding. By carefully evaluating the risks and potential rewards of lending, investors can make informed decisions that align with their financial goals and risk tolerance. It is important to conduct thorough due diligence, seek professional advice, and monitor the company’s performance throughout the lending period to mitigate risks and maximize returns.

FAQs

1. What are the risks of lending money to a company?

Lending money to a company carries risks such as default risk, interest rate risk, and market risk. It is important for investors to assess these risks and conduct due diligence before making any investment decisions.

2. How can investors mitigate the risks of lending money to a company?

Investors can mitigate the risks of lending money to a company by diversifying their investment portfolio, conducting thorough due diligence, and monitoring the company’s performance regularly.

3. What are the advantages of lending money to a company?

Lending money to a company can provide investors with a steady income stream through interest payments, potential capital appreciation, and the satisfaction of supporting businesses in need of funding.

4. What are some alternative investments to lending money to a company?

Some alternative investments to lending money to a company include stocks, real estate, mutual funds, and exchange-traded funds (ETFs).

5. How can investors determine the right amount to lend to a company?

Investors can determine the right amount to lend to a company by assessing their financial goals, risk tolerance, and investment horizon. It is important to consider these factors before committing capital to any lending opportunity.