Cash Loans for Business Owners

What do you mean?

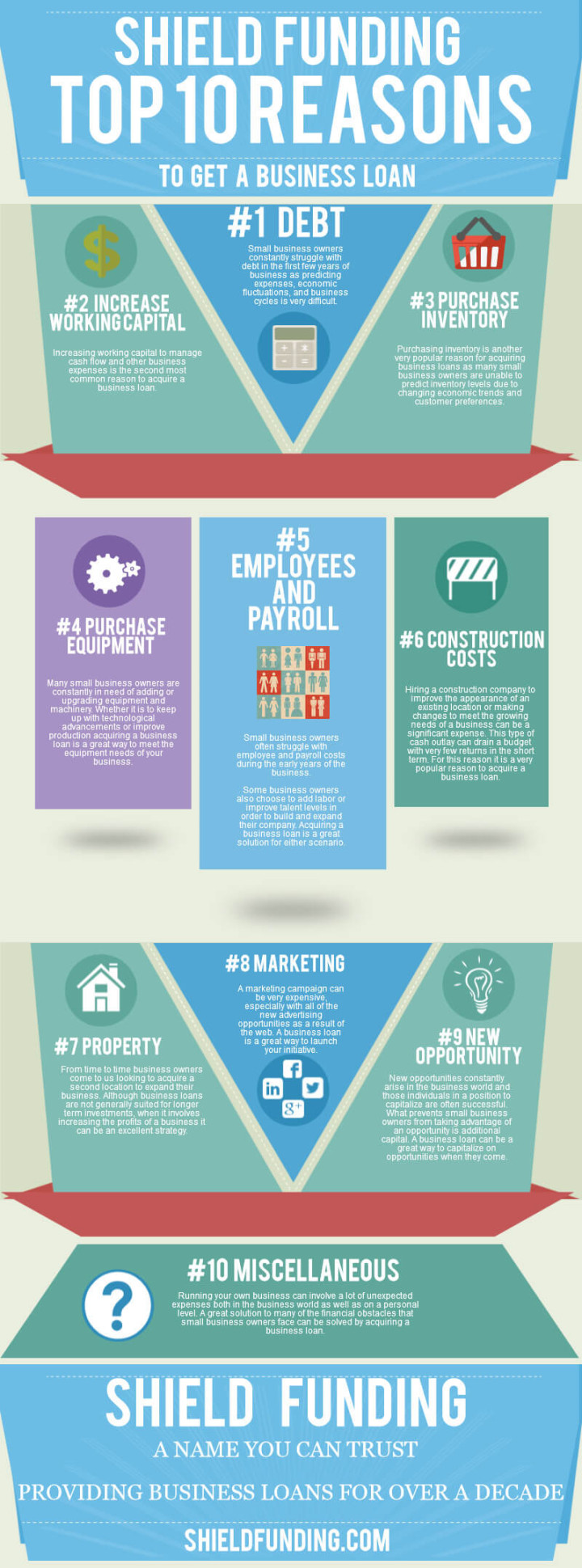

Cash loans for business owners are financial products designed specifically for entrepreneurs and business owners who need access to quick cash to grow their businesses, cover operating expenses, or manage cash flow challenges. These loans can be used for various purposes, such as purchasing inventory, investing in equipment, hiring additional staff, or expanding operations.

How can business owners access cash loans?

Business owners can access cash loans from a variety of sources, including traditional banks, online lenders, credit unions, and alternative lending institutions. The application process for cash loans typically involves providing documentation of the business’s financial health, such as tax returns, bank statements, and profit and loss statements.

What is known about cash loans for business owners?

Cash loans for business owners come in various forms, such as term loans, lines of credit, merchant cash advances, and asset-based loans. Each type of loan has its own eligibility requirements, interest rates, and repayment terms. Business owners should carefully evaluate their options and choose the loan product that best fits their needs and financial situation.

Solution for business owners in need of cash loans

For business owners in need of quick access to cash, online lenders can be a convenient and fast solution. Online lenders typically offer a simple application process, quick approval decisions, and funding within a few business days. Additionally, alternative lending institutions may be more willing to work with business owners who have less-than-perfect credit histories.

Information about cash loans for business owners

Before applying for a cash loan, business owners should carefully review the terms and conditions of the loan agreement, including the interest rate, repayment schedule, and any fees or penalties. It is important to understand the total cost of the loan and how it will impact the business’s finances in the short and long term.

FAQs

Q: Can business owners with bad credit qualify for cash loans?

A: Yes, some alternative lending institutions are willing to work with business owners who have less-than-perfect credit histories.

Q: How quickly can business owners access funds from cash loans?

A: Online lenders typically offer quick approval decisions and funding within a few business days.

Q: What are the common uses of cash loans for business owners?

A: Cash loans can be used for various purposes, such as purchasing inventory, investing in equipment, hiring additional staff, or expanding operations.

Q: How should business owners evaluate their options for cash loans?

A: Business owners should carefully review the terms and conditions of the loan agreement, including the interest rate, repayment schedule, and any fees or penalties.

Q: Are there different types of cash loans available for business owners?

A: Yes, business owners can access cash loans in various forms, such as term loans, lines of credit, merchant cash advances, and asset-based loans.