Exploring the Best Merchant Cash Advance Options

What do you mean by a Merchant Cash Advance?

Merchant cash advances are a popular form of financing for small businesses. They are not loans, but rather a way for businesses to receive a lump sum of cash in exchange for a percentage of their future credit card sales. This type of financing is typically used by businesses that have a high volume of credit card sales and need quick access to capital.

How do Merchant Cash Advances Work?

When a business applies for a merchant cash advance, the provider will review their credit card sales history to determine the amount of cash they are eligible to receive. Once approved, the business will receive the lump sum of cash, and the provider will then collect a percentage of the business’s daily credit card sales until the advance is paid back in full.

What is known about the Best Merchant Cash Advance Options?

There are many providers of merchant cash advances, each with their own terms and conditions. To find the best option for your business, it is important to compare rates, fees, and repayment terms. Some providers may offer lower rates but have higher fees, while others may have more flexible repayment options.

Solution for Finding the Best Merchant Cash Advance

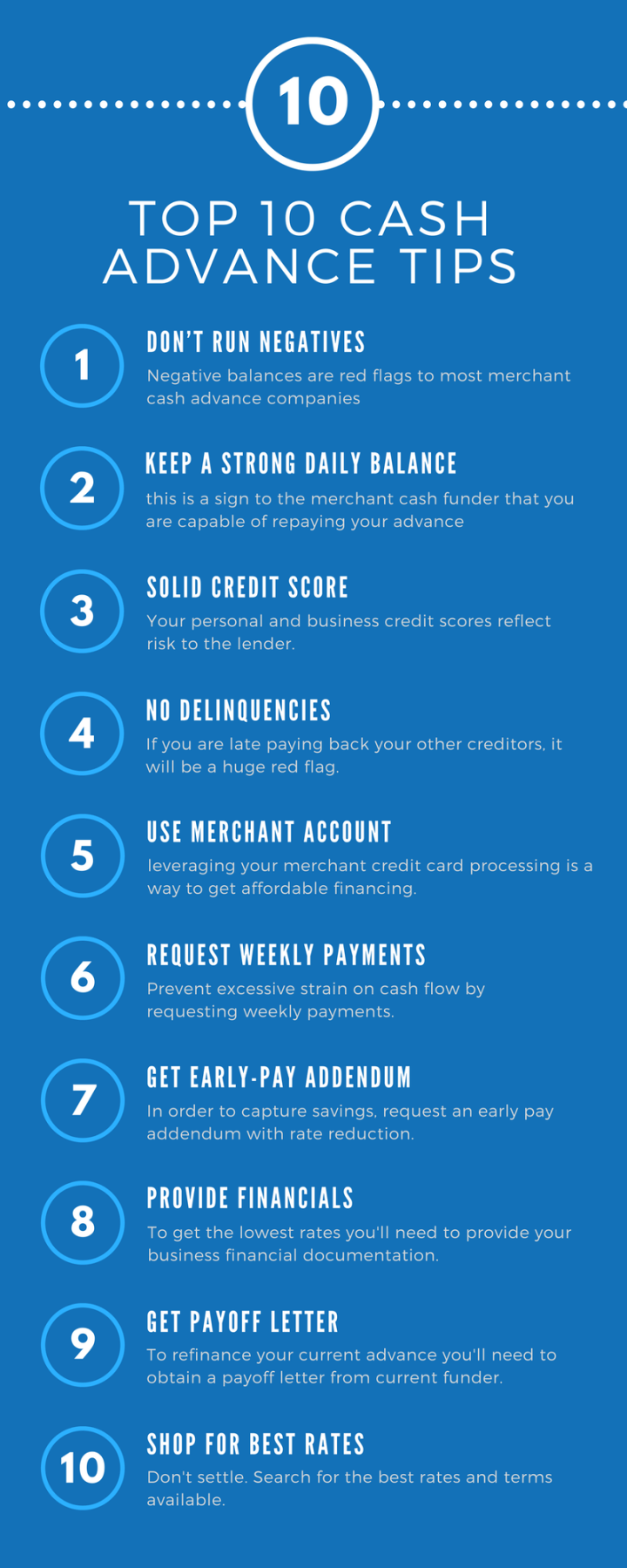

One way to find the best merchant cash advance option for your business is to research and compare multiple providers. Look for providers that have a good reputation, transparent terms, and competitive rates. It is also important to read the fine print and understand all the terms and conditions before signing any agreements.

Information about the Best Merchant Cash Advance Providers

There are many reputable merchant cash advance providers in the market, such as Square Capital, Rapid Finance, and National Funding. These providers offer competitive rates, fast approval times, and flexible repayment options. It is important to do your research and choose a provider that best fits your business’s needs.

Conclusion

Merchant cash advances can be a valuable financing option for small businesses in need of quick capital. By comparing rates, fees, and repayment terms from multiple providers, you can find the best option for your business. Remember to read the fine print and understand all the terms and conditions before entering into any agreements.

FAQs

1. Are merchant cash advances the same as loans?

No, merchant cash advances are not loans. They are a form of financing where businesses receive a lump sum of cash in exchange for a percentage of their future credit card sales.

2. How quickly can I get approved for a merchant cash advance?

Approval times for merchant cash advances can vary depending on the provider. Some providers offer fast approval times, while others may take longer to review your application.

3. Can I use a merchant cash advance for any business expenses?

Yes, you can use a merchant cash advance for any business expenses, such as purchasing inventory, equipment, or expanding your business.

4. What happens if my credit card sales decrease after receiving a merchant cash advance?

If your credit card sales decrease after receiving a merchant cash advance, you may still be required to repay the advance based on the agreed-upon percentage of your sales.

5. Are there any alternatives to merchant cash advances?

Yes, there are alternative financing options available for small businesses, such as business loans, lines of credit, and invoice financing. It is important to explore all your options and choose the best financing solution for your business.