Understanding Merchant Cash Advance Rates

What do you mean by Merchant Cash Advance Rates?

Merchant Cash Advance Rates refer to the fees and interest charged by a lender when providing a merchant cash advance to a business. A merchant cash advance is a type of financing where a business receives a lump sum of cash upfront in exchange for a percentage of their daily credit card sales.

How do Merchant Cash Advance Rates work?

When a business owner applies for a merchant cash advance, the lender will assess the business’s credit card sales history to determine the amount they are eligible to receive. The lender will then provide the business with a lump sum of cash, which they will repay through a percentage of their daily credit card sales.

What is known about Merchant Cash Advance Rates?

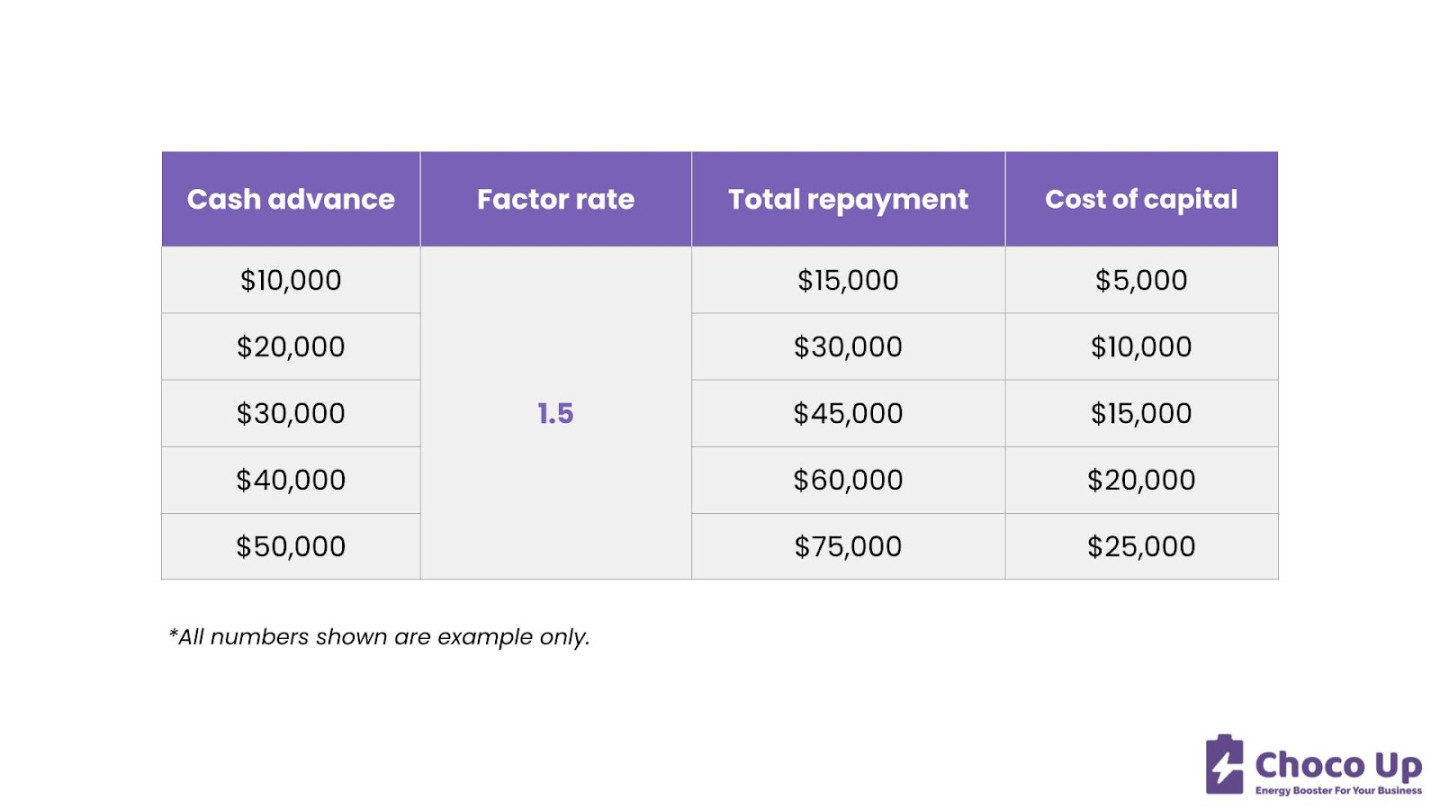

Merchant Cash Advance Rates can vary depending on the lender, the amount of the cash advance, and the terms of the agreement. Rates are typically higher than traditional loans, as they are considered a higher risk form of financing. The rates can be calculated as a factor rate, which is a decimal figure that represents the total amount to be repaid.

Solution for understanding Merchant Cash Advance Rates

Business owners should carefully review the terms and rates of a merchant cash advance before agreeing to the terms. It is important to understand the total cost of the advance and how it will impact the business’s cash flow. Comparing rates from multiple lenders can help business owners find the best deal for their specific needs.

Information on Merchant Cash Advance Rates

Merchant Cash Advance Rates are typically higher than traditional loan rates, as they are considered a higher risk form of financing. Rates can range from 1.14 to 1.48 depending on the lender and the terms of the agreement. It is important for business owners to carefully review the terms and rates before agreeing to a merchant cash advance.

Conclusion

Understanding Merchant Cash Advance Rates is essential for business owners looking to secure financing for their operations. By comparing rates from multiple lenders and carefully reviewing the terms of the agreement, business owners can make informed decisions that will benefit their bottom line in the long run.

FAQs about Merchant Cash Advance Rates

1. What factors determine Merchant Cash Advance Rates?

Merchant Cash Advance Rates are determined by factors such as the lender, the amount of the cash advance, and the terms of the agreement.

2. Are Merchant Cash Advance Rates higher than traditional loan rates?

Yes, Merchant Cash Advance Rates are typically higher than traditional loan rates due to the higher risk associated with this form of financing.

3. How can business owners find the best Merchant Cash Advance Rates?

Business owners can find the best Merchant Cash Advance Rates by comparing rates from multiple lenders and carefully reviewing the terms of the agreement.

4. What is a factor rate in relation to Merchant Cash Advance Rates?

A factor rate is a decimal figure that represents the total amount to be repaid in a merchant cash advance agreement.

5. What should business owners consider before agreeing to Merchant Cash Advance Rates?

Business owners should consider the total cost of the advance, how it will impact their cash flow, and whether the rates are competitive with other financing options before agreeing to Merchant Cash Advance Rates.