Cashflow Based Lending

What do you mean?

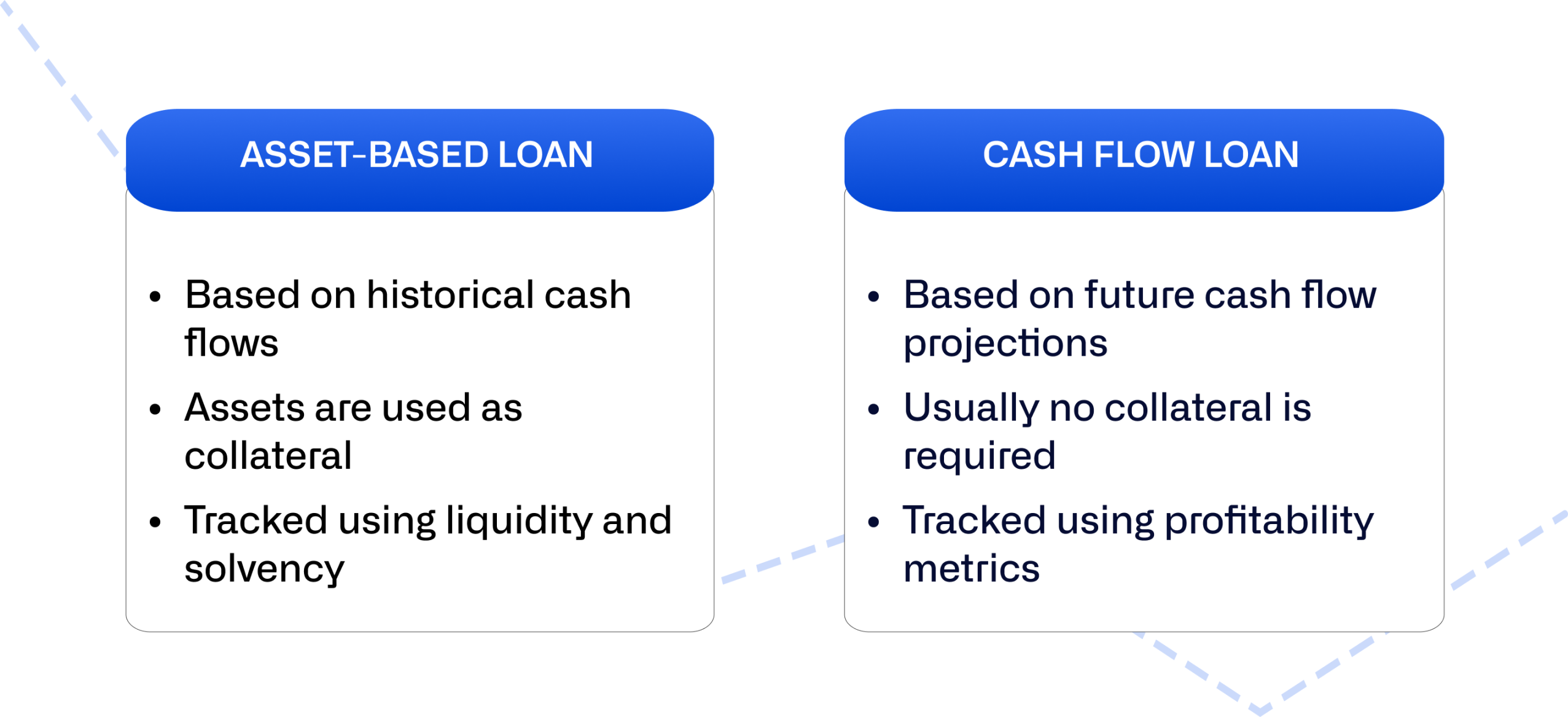

Cashflow based lending is a type of financing that focuses on a company’s cash flow rather than its assets. This type of lending is particularly beneficial for businesses that have strong cash flow but may not have substantial collateral to secure a traditional loan. Cashflow based lending allows businesses to borrow money based on their projected future cash flow, making it easier for them to access the funds they need to grow and expand.

How does it work?

When a company applies for cashflow based lending, the lender will evaluate the company’s cash flow statements to determine its ability to repay the loan. The lender will look at factors such as the company’s revenue, expenses, and projected future cash flow to assess the company’s financial health. Based on this information, the lender will determine the amount of money the company can borrow and the terms of the loan.

What is known about cashflow based lending?

Cashflow based lending is becoming increasingly popular among small and medium-sized businesses that may not have the assets to secure a traditional loan. This type of financing is often used to fund growth initiatives, such as expanding operations, purchasing equipment, or hiring additional staff. Cashflow based lending offers businesses flexibility and access to capital when they need it most.

Solution for businesses

For businesses looking to access funds quickly and without the need for substantial collateral, cashflow based lending can be an ideal solution. By focusing on cash flow rather than assets, businesses can secure the financing they need to achieve their goals and grow their operations. Cashflow based lending offers businesses the flexibility and freedom to use the funds as they see fit, without restrictions on how the money can be used.

Information about cashflow based lending

When applying for cashflow based lending, businesses will need to provide the lender with detailed financial information, including cash flow statements, profit and loss statements, and balance sheets. Lenders will use this information to assess the company’s financial health and determine the amount of money they can borrow. Businesses should be prepared to provide documentation to support their loan application and demonstrate their ability to repay the loan.

Conclusion

Cashflow based lending offers businesses a flexible and accessible way to access the funds they need to grow and expand. By focusing on cash flow rather than assets, businesses can secure financing even if they do not have substantial collateral. Cashflow based lending is an ideal solution for businesses looking to fund growth initiatives and achieve their goals.

FAQs

1. Is cashflow based lending suitable for all businesses?

Cashflow based lending is most suitable for businesses with strong cash flow but limited assets to secure a traditional loan.

2. How quickly can businesses access funds through cashflow based lending?

The time it takes to access funds through cashflow based lending can vary depending on the lender, but in general, businesses can access funds more quickly than with a traditional loan.

3. Are there any drawbacks to cashflow based lending?

One potential drawback of cashflow based lending is that it may come with higher interest rates or fees compared to traditional loans, as lenders are taking on more risk by not requiring collateral.

4. Can businesses use cashflow based lending for any purpose?

Businesses can typically use funds obtained through cashflow based lending for any business purpose, such as expanding operations, purchasing equipment, or hiring staff.

5. How can businesses improve their chances of approval for cashflow based lending?

Businesses can improve their chances of approval by maintaining strong cash flow, providing detailed financial information to lenders, and demonstrating their ability to repay the loan.

Hello there, I found your site by the use of Google while searching for a related subject, your website got here up, it appears good. I have bookmarked it in my google bookmarks.

I appreciate, cause I found just what I was looking for. You have ended my four day long hunt! God Bless you man. Have a nice day. Bye